INTRODUCTION

When starting a new assignment, the interim manager must quickly carry out an analysis of the performance of the organization in which he or she will be working for a few months. In the case of an assignment focused on the supply chain, this will depend on the scope of the assignment. Is it the upstream supply chain or the downstream supply chain? How big is the company? Is it an SME or a multinational? This diagnosis should be carried out within the very first days of the assignment. It will enable the manager :

-

- Quickly become familiar with the organization

- Provide the client with an overview of the situation and an initial action plan to address the initial problem.

- Offer Quick Win

To carry out this diagnosis, the manager will draw on his professional and managerial experience. But they also need to be able to apply a few simple tools that will enable them to structure their thinking and build a relevant action plan. The purpose of this article is mainly to share my experience on this subject, and to provide a few elements for rapidly building a Supply Chain diagnosis. It is obviously not intended to replace an MRP2 or Lean Manufacturing audit.

1. TOOLS FOR RAPID SUPPLY CHAIN DIAGNOSIS

The interim manager needs to be able to quickly grasp the issues at stake, the “pain points”, so as to keep integration time to a minimum. To achieve this, there’s no substitute for a standardized routine: it must be adapted to the environment (company size, current projects, regulatory constraints, social and human context, etc.) and to the nature of the assignment (change project, maturity, etc.). Here are the main headings.

Note that the elements to be followed are common to the majority of Supply Chain organizations, although there are some particularities, notably in the aeronautical and pharmaceutical sectors.

1.1. LES FIGURES « IMPOSEES » :

1.1.1. Comprendre l’organisation

- Analyze the organizational chart (when it exists …)

- Interview Supply Chain teams, as well as customers and suppliers involved in the process:

- Priority is given to Purchasing, Sales, Marketing and Methods functions.

- Depending on the nature of the assignment, R&D, industrialization, IT and other functions may be involved.

- Whenever possible, customers (the real ones!) and suppliers: nothing beats the opinion of suppliers on the performance of procurement plans!

1.1.2. Analyser les KPIs

- Are performance indicators representative of actual performance?

- Customer performance measurement: service level, OTD, OTF, Fill rate

- Inventories: how are they measured? In value and in coverage?

- Do you measure slow-moving products?

- Supplier performance and PDP/MPS.

1.1.3. Analyser les processus clefs

Demand management / Sales forecasting

- Does the company deliver from stock (MTS) or to order (MTO)?

- Does the organization have a demand management process?

- Is demand management fed by a structured process for building sales forecasts and integrating customer supply plans?

- Is there a management dialogue with customers?

- To understand and explain variations

- To define the rules of the game, in particular management horizons

- Are management parameters for finished products up to date and regularly reviewed (safety stock, minimum quantity/sales multiples, etc.)?

The S&OP / MPS process

- Is there a formal S&OP process?

- Are senior management/operations management sponsors and committed participants in the process?

- Are the process performance indicators relevant?

- Is there a right turn of the table?

- Do we speak the same language? What are the data aggregation criteria (commercial vs. technical families, euros vs. quantities, etc.)?

- Are aggregated data consistent? Are the large masses checked?

- Is the Agenda a standardized routine?

- What decisions are taken at the end of the process? Are they reported?

- Does PDP flow from PIC/ S&OP?

- Information system: Excel or a dedicated application?

MPS MRP

- Are management parameters reviewed at regular intervals?

- Do MPS and Appros planners master this parameterization correctly? For example, do an MRP core sample: take a finished product, a sub-assembly, a raw material and check the completeness and consistency of the data.

- How often are requirements calculated?

Sourcing

- Do procurement managers use MRP results to place orders? If not, which tools are preferred? Reorder point? Kanban? Heuristic method?

- Are there supplier supply programs? Is there a production and distribution routine? Is the reliability of these programs measured?

- How often do you exchange information with suppliers? Are there defined-frequency routines with critical suppliers?

Scheduling

- Is the workshop’s short-term scheduling guaranteed at regular intervals?

- Is it the result of MRP or are other methods used, such as Kanban?

- Are there communication areas on the shop floor where scheduling, achievements, performance and actions can be easily visualized?

Physical Logistics and Transport

- Organization and performance of warehouses/distribution centers: are logistics handled in-house or outsourced?

- Is transport organization aligned with customer delivery frequencies?

- Declaration of Origin / Bar Coding

1.2. LES FIGURES « LIBRES » :

Depending on the nature of the assignment, other topics may be analyzed. Generally speaking, these subjects are not the direct responsibility of the Supply Chain teams. However, they do influence the quality of their work and their ability to meet performance targets. Here are 3 high-impact examples.

1.2.1. Sourcing des fournisseurs et des usines / analyse de flux et du Leadtime

- As a priority, can we work with suppliers to reduce cycle times?

- If not, are there alternative sources? Can they be implemented within a reasonable timeframe? This is a particularly complex issue, especially in sectors such as aeronautics and pharmaceuticals, where qualification processes are demanding and time-consuming.

1.2.2. Gestion des références et du portefeuille

Inflation in the number of SKUs (Finished Products, Components or Raw Materials) is one of the main cost drivers in the Supply Chain.

Analysis of databases often shows an imbalance between SKUs “on the move” and a graveyard of SKUs that have remained static for several years.

These SKUs clutter up reporting and physical inventories, and complicate the operational processes of procurement and MRP managers.

- Is there a Phase In / Phase Out referral management process?

- Who is responsible for this process? Are Supply Chain teams involved?

This is a key point, particularly for industrial transfer projects.

1.2.3. Processus de lancement des produits nouveaux / Gestion des first Batch

80% of the cost of managing a product is defined before it is launched on the market. It is therefore essential to ensure that Supply Chain parameters are taken into account at this stage.

How are new products managed?

Are Supply Chain teams involved upstream in the development flow?

How are supplier choices validated? Factories? Production resources? Can OTD objectives influence these choices?

2. RESTITUTION TOOLS

Once the diagnostic phase has been completed, a performance review will help structure the mission’s roadmap. The following elements (SWOT, Performance Radar, PDCA) are the key elements of the contract review to validate the mission with the client.

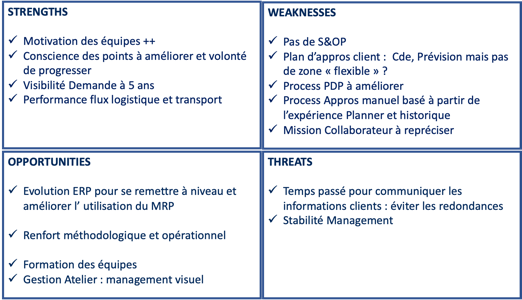

2.1. L’analyse SWOT (Strenghs, Weaknesses, Opportunities, Threats)

The SWOT will enable you to sort out the elements of the diagnosis. It will help to clearly explain the organization’s strengths and weaknesses.

The Strengths analysis helps to identify if there are any distinctive skills and characteristics to improve the chances of success.

The Opportunities and Weaknesses analysis will be an input to the action plan.

The Fears analysis will, if necessary, complete the action plan with a risk analysis.

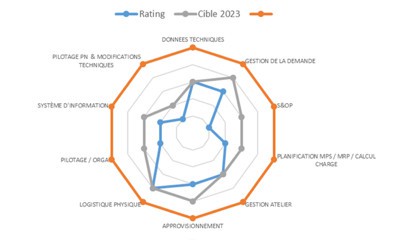

2.2. Radar de performance

For each of the criteria analysed, you should be able to assess :

- The performance to be achieved

- Achievable Performance

- Performance achievable to date, i.e. within the mission horizon

To build this radar, the interim manager defines a frame of reference, based on his experience. If he doesn’t have enough time to define it, he can use proven methods (Apics, Oliver Wight Questionnaire…).

Depending on the conditions of the mission, it’s ideal to draw up this radar with the teams, to really involve them and increase the chances of success.

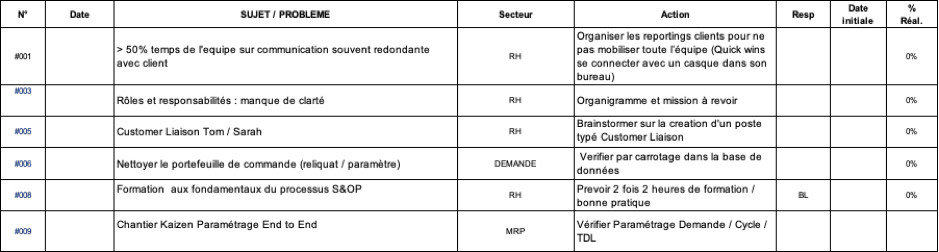

2.3. PDCA (Plan, Do, Check, Act)

The action plan is the interim manager’s roadmap. It must be validated by the teams and by the client.

This PDCA must be monitored regularly (ideally once or twice a month, depending on the nature of the assignment).

As far as possible, it should include Quick Wins to boost team morale and implement a continuous improvement dynamic.

2.4. Les pièges à éviter

- Don’t validate objectives before carrying out a diagnosis?

- Don’t promise the impossible: define realistic, achievable objectives within the timeframe of the assignment.

- Work with teams, not against them: ideally, involve teams in defining objectives.

- Taking all ideas at face value without checking their feasibility.

- Quickly identify internal role-playing, maintain neutrality

IN CONCLUSION

At the start of an assignment, the interim manager may find himself confronted with a fear of the unknown, and wonder “by which end to tackle the subject”….. These few pages are obviously not intended to provide “the answer”, nor an exhaustive vision of supply chain performance. However, they do provide a few keys. Every interim manager needs to be able to construct his or her own routine, so as to feel at ease, ease the transition and achieve the objectives agreed with the client. For my part, I systematically use these methods. They enable me to build up a repository of best practices, to improve the chances of success for future assignments.

Bruno LESTANG